WHAT IS A BOARD EVALUATION?

A Board evaluation is the process and means by which the board of directors as a unit; its committees and individual directors who comprise it; so seek to measure their respective performance and effectiveness; in discharging their stewardship responsibilities, relative to set objectives, plans and strategic challenges. Boards of Directors increasingly accept that an effective organisation starts at the top. Senior leadership must credibly demonstrate effectiveness to all stakeholders in the ecosystem in which the company they serve prospers. Boards are (increasingly) complex human, social and technical structures, therefore, being an effective director is becoming ever more difficult; mainly because legal and regulatory frameworks are becoming more complex in their engineering.

Evaluations lead to better performance. A Board evaluation must be principles based, not a science formula. The reason for this is the environments facing each body corporate differ so much and different issues will apply. It is therefore important not only for the Board to measure its effectiveness, but the evaluation methodology employed should also be suitably effective.

A quality evaluation will examine two core components well. First, human factors and secondly, process and structure factors. In our experience, many evaluations major on structure and process but do not deal well with the human factors. Does the board work well together as a team; deal properly with conflict; respect individual viewpoints based on an acceptance of each other’s skill and competence? Is it well lead through an effective Chair and quality Independent Non Executives? Because the strategic challenges facing most businesses are changing at a rapid rate; therefore, the Board must ensure as part of its stewardship and fiduciary responsibilities they optimally respond at both a unitary and individual director level to such changes to remain effective.

Who needs a Board Evaluation and Why?

If you are a listed plc in the FTSE 350 and above or the equivalent listing on the Irish Stock Exchange (“ISE”), Section 3, Provision 21 of the UK Corporate Governance Code 2018 mandates your Company Board to undertake a formal and rigorous annual evaluation of its own performance and that of its committees and individual directors, with an evaluation being carried out by an external facilitator at least once over three years.

The same requirement applies to High Impact regulated credit institutions and insurance undertakings, with codes of conduct for certain charities, not for profit and state organisations also following suit. Apart from the governance, legal and regulatory reasons cited, all companies should seek to ensure their top leadership is operating in an effective manner.

THE IMPORTANCE OF INDEPENDENT SPECIALISTS AND EXTERNAL FACILITATION

Provision 21 of the Corporate Governance Code 2018 demonstrates why you need to ensure that your external facilitator is independent and credible. The board should state in the annual report how performance evaluation of the board, its committees and its individual directors has been conducted. The annual report and accounts of the Company will state who the external facilitator is and if they have any other connection to the Company.

Watch out for Conflicts of Interest

When using an external facilitator, you should ensure that either the individual or firm involved does not have a conflict on interest; otherwise, this would potentially negate the value of the process. Conflict may manifest itself by way of being close to an individual board member;, or, if there are other engagements that person or firm may have with the Company. An externally facilitated evaluation should provide an “honest mirror” on Board effectiveness; biases or perceived biases will stop this from happening.

Public Interest Entities also appoint evaluators. However, in these cases, potential evaluators such as external audit firms are subject to EU restriction of service provisions. Further, periodic rotation of external audit firms under the same restrictions make it difficult for a Public Interest Entity to appoint a non-conflicted professional services provider. As we do not provide audit services, we are typically not subject to restrictions or many conflicts.

Our advice? Ensure that your panel of potential service providers is sufficiently diverse thereby meeting requirements and keep your costs under control. There are very view evaluation specialists in the market; it makes sense to include credible ones on your list of potential service providers.

WHY BOARD MATTERS INTERNATIONAL?

- The firm is comprised of experienced directors who sit on Boards.

- Our partners have all come from the professional and / or financial services environments with top class academic backgrounds and over 20 years of achievement.

- Our evaluation, initially developed by Quinn Associates for over 9 years, takes a 360 degree wholistic approach to its review and is quite different to other approaches taken on the market

- We are a discreet firm who partner with our clients in a low key manner

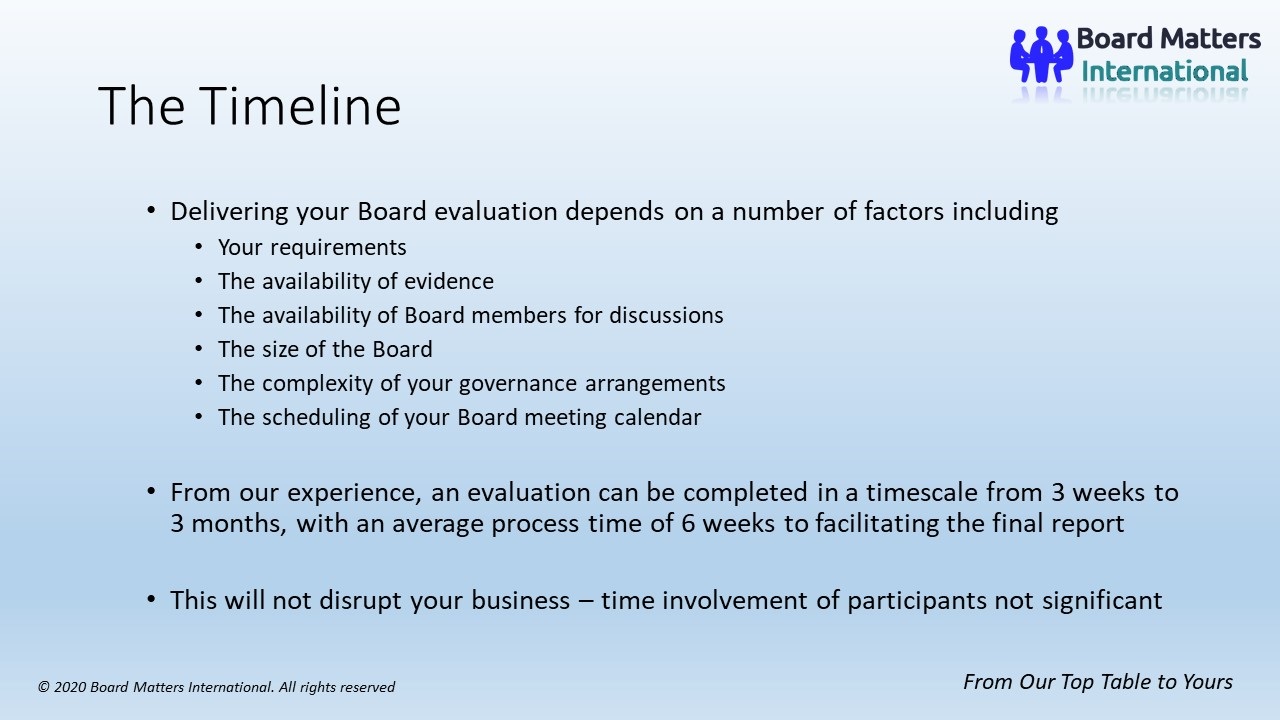

- Our process is credible and efficient; we do not take up too much management time

- Our firm has invested significantly in the development of methodologies that deliver an outcome of proven quality that can actually be practically applied

- We specialise in this service. Any add on service that may be provided by us is derived directly from the evaluation process.

- Conflict of interest risk will be low as we will not normally be engaged with you in any other capacity initially

To obtain an overview of our evaluation methodology, please click the links on the page. For a confidential discussion of your requirements, contact us today